Cheap Mitsubishi Diamante Car Insurance in 2026 (Top 10 Low-Cost Companies)

State Farm, USAA, and Progressive offer the best rates for cheap Mitsubishi Diamante car insurance, starting at $48 monthly. These providers excel in affordability, coverage options, and customer service, making them ideal for Mitsubishi Diamante owners seeking reliable and economical insurance solutions.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated October 2024

Company Facts

Min. Coverage for Mitsubishi Diamante

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mitsubishi Diamante

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mitsubishi Diamante

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, USAA, and Progressive stand out as the best providers for cheap Mitsubishi Diamante car insurance, offering a combination of low costs and high-quality coverage.

These companies are recognized for their comprehensive coverage options, competitive pricing, and excellent customer service. Securing affordable insurance for your Mitsubishi Diamante is crucial, and these providers ensure a balance of cost-effectiveness and reliable protection. For further information, refer to our article titled “Best Mitsubishi Car Insurance Discounts.”

Our Top 10 Company Picks: Cheap Mitsubishi Diamante Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 B Safety Discounts State Farm

#2 $52 A++ Military Rates USAA

#3 $57 A+ Safe Driving Progressive

#4 $63 A++ Advanced Safety Geico

#5 $68 A+ New Car Allstate

#6 $72 A+ Vanishing Deductible Nationwide

#7 $77 A++ IntelliDrive Program Travelers

#8 $81 A Custom Coverage Liberty Mutual

#9 $86 A Signal App Farmers

#10 $91 A Student Discounts American Family

Explore their policies to find tailored coverage that meets your specific driving needs and budget.

Enter your ZIP code below in our free tool to start seeing quotes today.

- State Farm is the top pick for Mitsubishi Diamante insurance

- Tailored coverage options address specific needs of Mitsubishi Diamante owners

- Competitive rates enhance affordability for Mitsubishi Diamante insurance

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm insurance review & ratings offers Mitsubishi Diamante car insurance starting at just $48 monthly, making it an affordable option.

- Bundling Policies: Significant discounts are available for bundling multiple policies such as home and auto.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage Mitsubishi Diamante drivers, enhancing savings for those who drive less.

Cons

- Limited Multi-Policy Discount: Compared to competitors, State Farm’s multi-policy discount might be lower, affecting those looking for the best bundling rates.

- Premium Costs: Even with discounts, premiums may be higher for certain levels of coverage, particularly for comprehensive plans.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Rates

Pros

- Exceptional Financial Rating: USAA’s A++ AM Best rating indicates superior financial stability and reliability.

- Tailored Discounts for Military: Special rates and discounts are available for military members and their families, fitting the needs of those in service.

- Low Rates for Veterans: At $52 monthly, USAA insurance review & ratings offers competitive rates for Mitsubishi Diamante insurance for veterans and military personnel.

Cons

- Exclusivity: USAA’s services are only available to military members, veterans, and their families, limiting access for the general public.

- Limited Physical Locations: Fewer agent offices nationwide, which might affect those who prefer face-to-face service.

#3 – Progressive: Best for Safe Driving

Pros

- Rewards for Safe Drivers: Progressive offers discounts for safe drivers, which can be tracked through their Snapshot program, rewarding safe driving habits with lower rates. Read up on the “Progressive Insurance Review & Ratings” for more information.

- Flexible Coverage Options: Progressive provides a range of coverage choices that cater to different needs and budgets, including liability and full coverage options for Mitsubishi Diamante.

- Dedicated Support for Claims: With an A+ AM Best rating, Progressive is known for robust support during claims, ensuring a smoother process for customers.

Cons

- Higher Rates for High-Risk Drivers: Progressive may charge significantly higher rates for drivers considered high-risk, which could impact those with less than perfect driving records.

- Varied Customer Satisfaction: Customer satisfaction can vary widely depending on the region and specific experiences with claims.

#4 – Geico: Best for Advanced Safety

Pros

- Advanced Safety Feature Discounts: Discounts are available for Mitsubishi Diamante cars equipped with advanced safety features, promoting the use of technology for safer driving.

- Competitive Pricing: Geico car insurance discounts offers Mitsubishi Diamante insurance at $63 monthly, which is competitive considering the extensive coverage.

- Strong Financial Stability: With an A++ rating from AM Best, Geico stands as a financially robust insurer.

Cons

- Generic Customer Service: Some customers might find Geico’s service less personalized, as reported in various customer reviews.

- Policy Management Mostly Online: Customers preferring in-person interactions may find Geico’s predominantly online service model less appealing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for New Car

Pros

- New Car Replacement: Allstate insurance review & ratings offers new car replacement for recent model Mitsubishi Diamantes, ensuring owners can recover their vehicle’s full value in case of total loss.

- Multiple Discount Opportunities: Includes discounts for new cars, anti-theft devices, and full payments, enhancing affordability for Mitsubishi Diamante owners.

- Strong Local Agent Network: Provides personalized service through its extensive network of local agents.

Cons

- Higher Starting Rates: Starting at $68 monthly, Allstate’s rates are higher compared to some other insurers on the list.

- Variable Rates by State: Premiums can vary significantly based on the state, potentially affecting those in higher-cost areas.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide insurance review & ratings offers a vanishing deductible that rewards safe driving by reducing your deductible for each year of accident-free driving, ideal for Mitsubishi Diamante owners.

- Flexible Payment Options: Offers a range of payment plans to suit different budgets, helping manage insurance expenses more effectively.

- Strong Coverage Options: Nationwide provides a variety of coverage options, including comprehensive and collision coverage for Mitsubishi Diamantes.

Cons

- Higher End Premiums: At $72 monthly, Nationwide’s rates are on the higher end compared to some other providers.

- Mixed Customer Reviews: Some customers report varied experiences with claims processing and customer service.

#7 – Travelers: Best for IntelliDrive Program

Pros

- Usage-Based Savings: The IntelliDrive program tracks driving behavior and offers potential savings based on performance, which can significantly reduce premiums for safe Mitsubishi Diamante drivers.

- Broad Coverage Options: Extensive options for customization of policies, allowing drivers to tailor their coverage to their specific needs.

- Robust Financial Health: With an A++ AM Best rating, Travelers insurance review & ratings is known for its financial reliability and capacity to handle claims.

Cons

- Program Requirements: The IntelliDrive program requires data sharing of driving habits, which may not be appealing to all customers.

- Higher Rates Without Program: Rates can be relatively higher for those who opt out of the IntelliDrive program.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Custom Coverage

Pros

- Highly Customizable Policies: Liberty Mutual review & ratings offers highly customizable insurance options, allowing Mitsubishi Diamante owners to closely match their coverage needs.

- Accident Forgiveness: Offers accident forgiveness policies, which can prevent your rates from increasing after your first accident.

- Multiple Discounts Available: Provides a variety of discounts including for newly retired individuals and those with multiple policies.

Cons

- Higher Pricing: Starting at $81 monthly, Liberty Mutual tends to have higher base rates compared to some other insurers.

- Varied Customer Service Experiences: Reports indicate that customer service quality can vary widely, impacting customer satisfaction.

#9 – Farmers: Best for Signal App

Pros

- Rewards for Safe Driving: The Signal app monitors driving behavior and offers discounts for safe driving, directly benefiting conscientious Mitsubishi Diamante drivers.

- Coverage for Custom Parts: Farmers insurance review & ratings offers insurance that covers custom parts and equipment, a valuable feature for modified Mitsubishi Diamantes.

- Comprehensive Claims Service: Known for comprehensive support during claims, easing the process for policyholders.

Cons

- Higher Premiums: Farmers’ rates start at $86 monthly, making it one of the more expensive options.

- App-Based Monitoring: The use of the Signal app involves continuous monitoring, which might not be preferred by all drivers.

#10 – American Family: Best for Student Discounts

Pros

- Good Discounts for Students: American Family insurance review & ratings offers significant discounts for students, which can make it a cost-effective option for young Mitsubishi Diamante drivers.

- Strong Local Agent Support: Known for its strong network of agents providing personalized service.

- Wide Range of Discounts: Apart from student discounts, offers multiple savings opportunities such as for safe driving and low mileage.

Cons

- Higher Rates in Certain States: Premiums can be higher in certain states, affecting affordability.

- Limited Availability: American Family is not available in all states, which may limit options for some drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

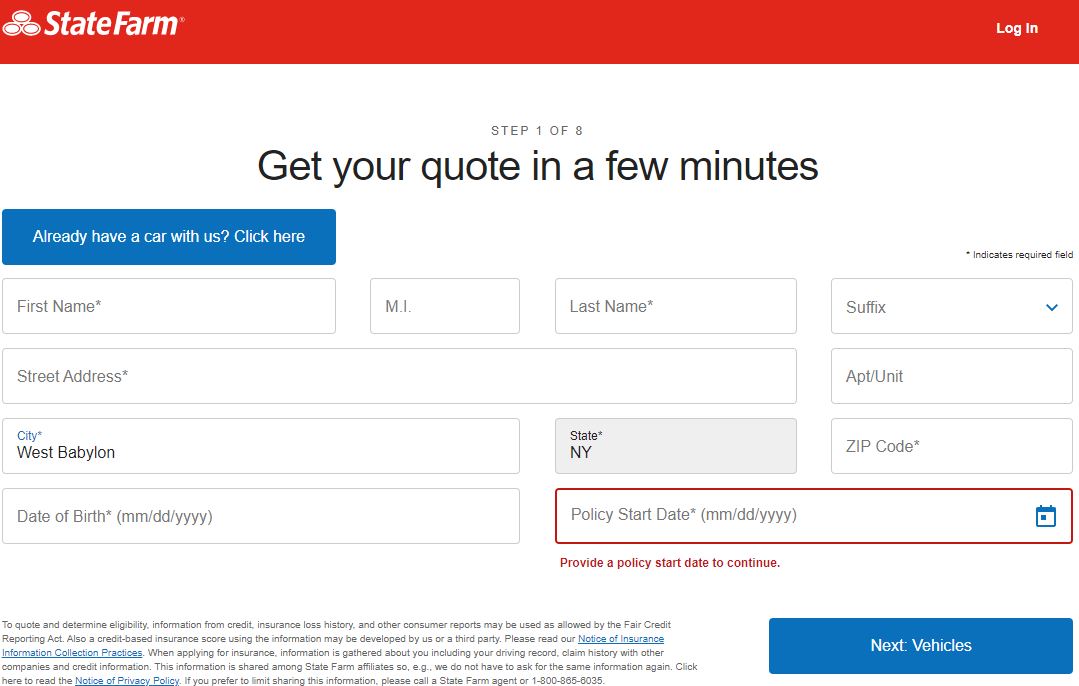

Comparative Monthly Premiums for Mitsubishi Diamante Insurance

When exploring Mitsubishi Diamante car insurance, understanding how monthly rates vary by coverage level across different providers is crucial. The table below offers a detailed comparison between the costs of minimum and full coverage options from several insurance companies.

Mitsubishi Diamante Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $68 $113

American Family $91 $137

Farmers $86 $132

Geico $63 $108

Liberty Mutual $81 $127

Nationwide $72 $117

Progressive $57 $102

State Farm $48 $95

Travelers $77 $122

USAA $52 $98

For owners of a Mitsubishi Diamante, monthly insurance rates can differ significantly depending on the chosen level of coverage. State Farm car insurance review & rating offers the most affordable minimum coverage at $48 and also competitive full coverage at $95 monthly. Progressive and USAA also present lower-cost options, with minimum coverage rates at $57 and $52 respectively, and full coverage at $102 and $98.

On the higher end, American Family charges $91 for minimum and $137 for full coverage, making it one of the pricier options. This spread in pricing highlights the importance of comparing both coverage levels and providers when searching for the most cost-effective car insurance for a Mitsubishi Diamante.

Factors That Influence the Cost of Mitsubishi Diamante Car Insurance

When it comes to car insurance rates for your Mitsubishi Diamante, several key factors play a role in determining the cost. One of the most significant factors is the type and amount of coverage you choose. The more comprehensive your coverage, the higher your insurance premiums are likely to be.

Additionally, factors such as your age, driving history, and credit score can also influence the cost of your insurance. Insurance companies consider these variables when assessing the level of risk associated with providing coverage for your Diamante.

Another important factor is the location where you reside and primarily drive your Mitsubishi Diamante. Insurance rates can vary greatly depending on your geographic location due to factors such as the crime rate, population density, and the frequency of accidents in that area. Urban areas and regions with higher incidents of theft or vandalism generally have higher insurance rates compared to rural areas.

Understanding the Insurance Coverage Options for Mitsubishi Diamante

When it comes to insuring your Mitsubishi Diamante, there are several coverage options available to consider. The most basic form of coverage is liability insurance, which typically protects you financially if you cause an accident and are responsible for any bodily injury or property damage to others. However, liability insurance does not cover damage to your own vehicle.

If you want coverage for your Diamante in case of accidents or theft, comprehensive and collision coverage can be added to your policy. Comprehensive coverage protects against non-accident-related damage, such as theft, vandalism, or natural disasters. Meanwhile, collision coverage covers damage to your vehicle in the event of an accident, regardless of who is at fault.

Additionally, you may also consider adding personal injury protection (PIP) insurance and uninsured/underinsured motorist coverage to your policy. PIP coverage helps cover medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. Uninsured/underinsured motorist coverage protects you if you’re in an accident with a driver who lacks sufficient insurance to cover damages.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Getting Affordable Car Insurance for Your Mitsubishi Diamante

Now that we’ve explored coverage options for your Mitsubishi Diamante, here are tips for securing affordable insurance. Maintaining a good driving record is crucial, as insurance companies reward safe drivers with lower premiums due to their reduced accident risk. Avoiding traffic violations and accidents is key to minimizing insurance costs.

Comparing car insurance rates from multiple providers is also crucial in finding the best deal for your Mitsubishi Diamante. Each insurance company has its own rating system, which means rates can vary significantly. By obtaining quotes from various providers and comparing their prices, you can ensure that you are getting the most competitive rate for your desired coverage.

To save on Mitsubishi Diamante car insurance, capitalize on available discounts. Insurance companies often provide savings for safe driving, bundling policies, or adding features like anti-theft devices and anti-lock brakes. Discounts for completing defensive driving courses are also common.

Exploring Discounts and Savings Opportunities for Insuring Your Mitsubishi Diamante

Exploring discounts is key to saving on Mitsubishi Diamante car insurance. Various discounts offered by insurers can lower premiums based on your driving record, Diamante’s safety features, age, or organizational affiliations. A common discount is the safe driver discount, available to those with a clean driving record. Insurance companies reward safe drivers with lower premiums due to their lower risk.

Another discount to consider is the multi-policy discount. This discount can be obtained by bundling your Mitsubishi Diamante car insurance with other insurance policies, such as homeowner’s or renter’s insurance, with the same provider. By combining your policies, you can usually save money on each policy’s premium.

Additionally, insurers often provide discounts for Mitsubishi Diamantes equipped with safety features like anti-theft devices, anti-lock brakes, or airbags, which can lower theft or accident risks and may reduce your rates. Since discounts vary by insurer, it’s advisable to contact several providers to discover the best savings opportunities for your vehicle.

The Role of Deductibles in Determining the Cost of Insurance for Your Mitsubishi Diamante

When it comes to determining the cost of insurance for your Mitsubishi Diamante, the deductible plays a significant role. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in to cover any damages or losses.

The higher your deductible, the lower your insurance premiums are likely to be. However, it’s important to strike a balance between a deductible that is manageable for you financially and a premium that is affordable. Setting your deductible too high could leave you with significant out-of-pocket costs in the event of an accident or other covered event.

It’s important to carefully evaluate your financial situation and budget to determine what deductible amount makes the most sense for you. While a higher deductible can lower your insurance premiums, it’s essential to have enough savings set aside to cover your deductible if an incident occurs necessitating a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Location Impacts the Price You Pay for Car Insurance on Your Mitsubishi Diamante

When insuring your Mitsubishi Diamante, it’s important to understand the impact of your location on the price you pay for car insurance. Insurance companies take various factors into account when determining insurance rates, and one of those factors is your location. Where you live can greatly influence the cost of your insurance premiums.

Melanie Musson Published Insurance Expert

Urban areas typically have higher insurance rates compared to rural areas. This is due to factors such as higher population density, increased traffic congestion, and a greater likelihood of accidents and theft. Insurance companies view urban areas as higher-risk environments for vehicles, resulting in higher premiums.

Additionally, the crime rate in your area and the frequency of accidents can also impact your insurance rates. Areas with higher rates of theft or vandalism will likely have higher premiums to compensate for the increased risk. Similarly, areas with a higher frequency of accidents will see higher insurance rates as well.

It’s important to consider the cost of car insurance when deciding where to live or move, especially if you’re considering a relocation to a different city or state. Researching insurance rates in different areas can give you a better understanding of the potential financial implications of living in different locations. Discover additional details in our guide titled “Best Car Insurance for Safe Drivers in California.”

Expert Advice on Finding the Best Car Insurance Deals for Your Mitsubishi Diamante

Finding the best car insurance deals for your Mitsubishi Diamante may seem daunting, but with a little research and expert advice, you can navigate the process with confidence. To help you in your search for the best insurance deals, we’ve gathered some expert advice to assist you.

Firstly, comparing car insurance quotes from various providers is essential, as each has its own rating system, causing rates to differ significantly. This comparison helps identify the most competitive rates for the coverage you need. Additionally, consider the reputation and customer service of the insurers. Opt for companies with solid financial health and a proven track record of good customer service.

Online reviews and ratings can provide valuable insights into other customers’ experiences with specific insurers. Consulting with insurance professionals or independent agents can be advantageous. These experts provide deep industry insights, helping secure the best car insurance deals for your Mitsubishi Diamante, uncover additional discounts, clarify policy details, and offer tailored advice.

Common Mistakes to Avoid When Insuring Your Mitsubishi Diamante to Save Money

When insuring your Mitsubishi Diamante, avoid common pitfalls to save money and secure affordable coverage. A frequent error is not comparing rates from various insurers, whose pricing can differ widely due to distinct rating systems. Skipping this step often leads to paying more for the same coverage.

Another mistake is not taking advantage of available discounts. Many insurance companies offer various discounts based on factors such as your driving record, safety features on your vehicle, or bundling multiple policies. Failing to inquire about discounts that you may be eligible for can mean missing out on potential savings.

Additionally, not understanding your coverage options and only selecting the bare minimum required by law can also be a costly mistake. While opting for minimum coverage may seem like a way to save money in the short term, it can leave you financially vulnerable if you are involved in an accident or experience a loss that is not covered by your policy.

Lastly, failing to regularly review and update your policy can also be a mistake. Life circumstances, such as moving, marriage, or purchasing a home, can impact your insurance needs. Neglecting to update your policy to reflect these changes can result in inadequate coverage or missed savings opportunities. Explore insurance discounts in our comprehensive article titled “Best Homeowners Insurance.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Your Mitsubishi Diamante Car Insurance With Other Policies

When insuring your Mitsubishi Diamante, consider bundling your car insurance with other policies like homeowner’s or renter’s insurance. Bundling can lead to significant savings, as many insurers offer discounts for multiple policies, reducing your overall insurance costs effectively. Bundling your policies can also simplify your insurance experience.

By consolidating your policies with one provider, you have a single point of contact for all your insurance needs, making it easier to manage and make changes to your coverage. Furthermore, bundling your car insurance with other policies can provide added convenience and peace of mind. Should a natural disaster damage both your home and car, bundling policies with one provider can streamline claims and ensure smoother resolution.

It’s worth noting that while bundling can offer many advantages, it’s still important to regularly review your policies and insurance needs. Even when bundling, comparing rates from multiple providers can help ensure that you are getting the most competitive price for your coverage. Discover more by exploring our guide titled “What is Payment bundling?”

Exploring Different Types of Coverage Available for Your Mitsubishi Diamante and Their Costs

When insuring your Mitsubishi Diamante, it’s important to understand the types and costs of coverage. Liability insurance, often required by law, covers injuries and damages to others if you’re at fault in an accident. Its cost varies based on your driving record, age, and location, and is generally cheaper than other types of insurance.

Ty Stewart Licensed Insurance Agent

For coverage of your own vehicle, consider adding comprehensive and collision insurance. Comprehensive insurance covers non-accident damage like theft and natural disasters, while collision insurance covers accident-related damage to your Diamante, regardless of fault. Both options offer more protection but are pricier than basic liability insurance.

Consider adding personal injury protection (PIP) and uninsured/underinsured motorist coverage to your policy. PIP helps cover medical expenses from accidents, regardless of fault, while uninsured/underinsured coverage offers protection against drivers lacking adequate insurance. Learn more about what we offer in our article titled “How does State Farm handle claims involving hit-and-run accidents?”

Costs vary based on location and state requirements. When choosing coverage for your Mitsubishi Diamante, assess your budget, the car’s value, and your risk tolerance. Consulting with insurance professionals can guide you to make informed decisions about your coverage needs. Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

Frequently Asked Questions

What factors affect the cost of Mitsubishi Diamante car insurance?

The cost of Mitsubishi Diamante car insurance can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductibles, and the insurance company’s pricing policies.

For additional details, explore our comprehensive resource titled “Car Driving Safety Guide for Teens and Parents.”

Are Mitsubishi Diamante cars expensive to insure compared to other vehicles?

Insurance costs for Mitsubishi Diamante cars can vary depending on individual circumstances. While they may not be the most expensive to insure, factors such as the car’s value, repair costs, and safety features can impact insurance rates.

Can I get discounts on Mitsubishi Diamante car insurance?

Yes, many insurance companies offer discounts that can help lower the cost of Mitsubishi Diamante car insurance. These discounts may include safe driver discounts, multi-policy discounts, anti-theft device discounts, and more. It’s recommended to inquire with your insurance provider about available discounts.

Is it necessary to have full coverage insurance for a Mitsubishi Diamante?

Whether full coverage insurance is necessary for a Mitsubishi Diamante depends on individual circumstances and preferences. If the car is financed or leased, the lender may require full coverage. However, if the car is older or has a lower value, some drivers may opt for liability coverage only.

How can I find affordable Mitsubishi Diamante car insurance?

To secure affordable Mitsubishi Diamante car insurance, compare quotes from various providers, maintain a clean driving record, opt for higher deductibles, bundle policies, and utilize discounts. Thoroughly review each provider’s coverage and customer feedback to choose the best plan for your needs.

To find out more, explore our guide titled “Lesser Known Car Insurance Discounts.”

Are Mitsubishi’s cheap to insure?

Relative to other non-luxury brands, Mitsubishis generally have higher monthly insurance costs. Nonetheless, the exact insurance price for Mitsubishis can differ based on personal factors like your ZIP code, driving record, and the particular model.

Which brand of car has the cheapest insurance?

Is a Mitsubishi Mirage cheap to insure?

Insuring a Mitsubishi Mirage tends to be costlier than the average vehicle. On average, full coverage insurance for a Mirage is approximately $183 per month, whereas liability-only coverage typically costs about $83 monthly.

What type of car insurance is cheapest?

Generally, fully comprehensive insurance tends to be the most affordable option, although individual circumstances can affect the prices.

To learn more, explore our comprehensive resource on “What is included in comprehensive car insurance?”

Is it a good idea to buy a Mitsubishi?

Safety and fuel efficiency differ across models; while some earn high safety ratings and accolades, others encounter frequent problems such as transmission failures. Nevertheless, Mitsubishi models like the Outlander and Mirage are recognized for their cost-effectiveness and safety, presenting suitable choices for certain drivers.

Do Mitsubishi cars last a long time?

What color car is the most expensive to insure?

Who typically has the cheapest insurance?

Is Mitsubishi cheap to maintain?

Are Mitsubishi Mirage expensive to fix?

Do Mitsubishi cars hold their value?

Which one is better, Toyota or Mitsubishi?

What’s so special about Mitsubishi?

Why is Mitsubishi not popular in the US?

Why did Mitsubishi discontinue?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.