Cheap Chevrolet Tahoe Car Insurance in 2026 (Big Savings With These 10 Companies!)

USAA, Erie, and Auto-Owners lead as the top providers of cheap Chevrolet Tahoe car insurance, offering competitive rates starting at just $53 monthly. Renowned for their affordability and comprehensive coverage for the Tahoe, these companies set the industry standard, making them the ideal choice.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

Company Facts

Min. Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Tahoe

A.M. Best Rating

Complaint Level

Pros & Cons

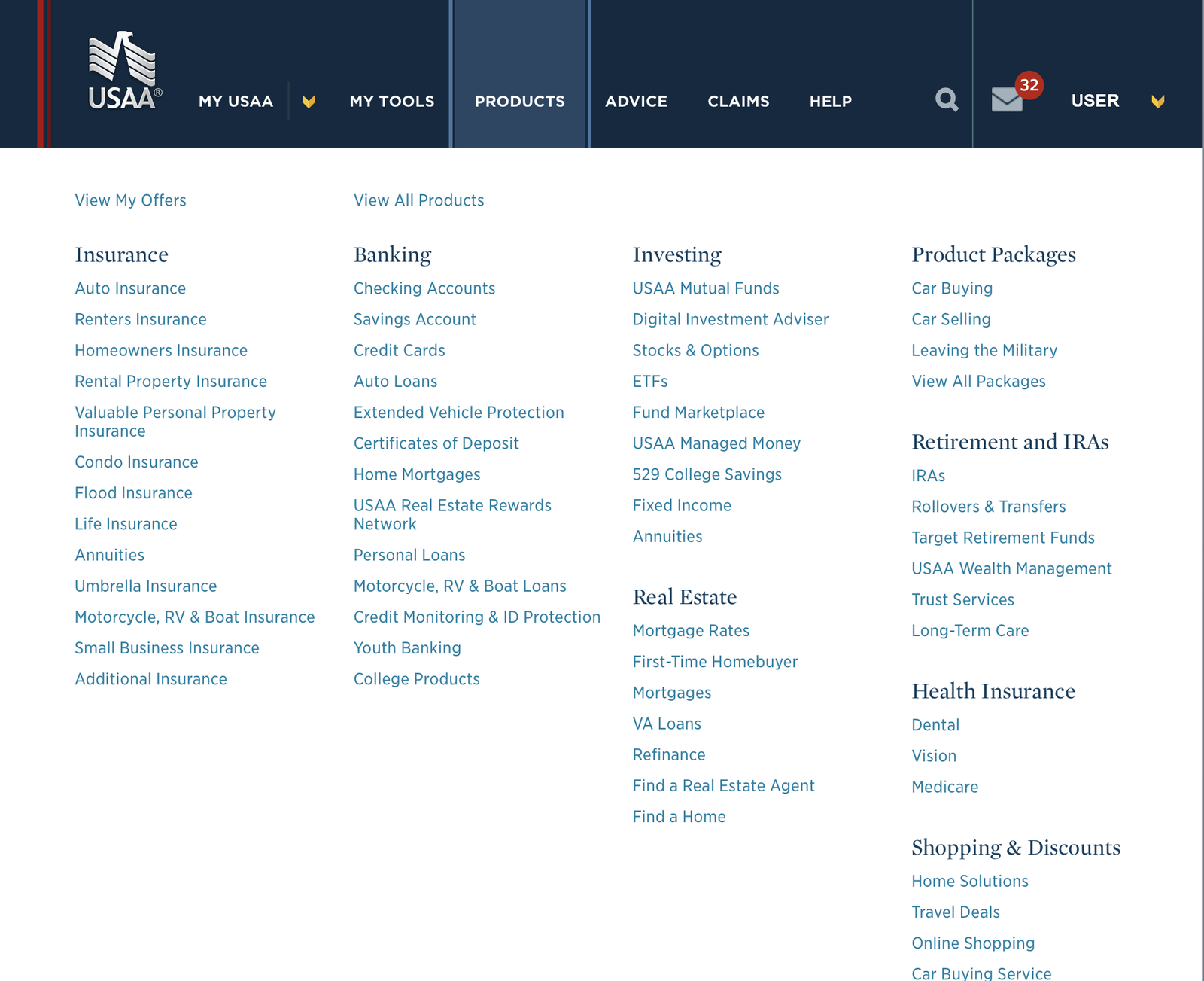

The top picks for cheap Chevrolet Tahoe car insurance are USAA, Erie, and Auto-Owners, known for their affordable policies and reliable coverage.

These companies provide excellent value, balancing cost with comprehensive protection for Tahoe owners. Navigating through the myriad of options, this article will guide you on how to secure a cost-effective policy while ensuring your vehicle is well-protected.

Our Top 10 Company Picks: Cheap Chevrolet Tahoe Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $53 A++ Military Savings USAA

#2 $58 A+ Personalized Policies Erie

#3 $62 A++ Accidents Auto-Owners

#4 $66 A++ High-Value Vehicles Chubb

#5 $69 B Financial Strength State Farm

#6 $76 A++ Specialized Coverage Travelers

#7 $84 A+ Roadside Assistance Progressive

#8 $89 A+ Multi-Policy Savings Nationwide

#9 $96 A High-Risk Coverage The General

#10 $102 A Safe-Driving Discounts Liberty Mutual

By understanding the factors that affect your premiums, you can make an informed decision tailored to your specific needs. Learn more in our “Chevrolet Car Insurance Discount.”

Enter your ZIP code above to get personalized insurance quotes tailored to your needs and budget.

- USAA stands out as the top pick for Chevrolet Tahoe car insurance

- Coverage options for the Tahoe address both common and unique driving risks

- Specific benefits for Tahoe owners include discounts for safety features

Chevrolet Tahoe Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Auto-Owners $62 $172

Chubb $66 $180

Erie $58 $148

Liberty Mutual $102 $196

Nationwide $89 $190

Progressive $84 $182

State Farm $69 $167

The General $96 $202

Travelers $76 $179

USAA $53 $153

The cost of insuring a Chevrolet Tahoe can differ significantly depending on the level of coverage and the insurance company you select. For minimum coverage, rates start as low as $53 with USAA and can go up to $102 with Liberty Mutual review & ratings.

On the other hand, full coverage premiums are considerably higher, with USAA again offering the most competitive rate at $153 per month, whereas The General presents the highest at $202. Companies like Erie and Auto-Owners offer middle-ground options at $148 and $172, respectively, balancing affordability with comprehensive protection.

This variation in pricing highlights the importance of comparing both coverage levels and providers to find the best insurance solution for your needs.

Factors That Influence Chevrolet Tahoe Car Insurance Rates

Several factors can influence the cost of car insurance for your Chevrolet Tahoe. Insurance companies take into account variables such as your age, driving record, location, credit score, and the model year of your Tahoe when determining insurance rates.

Additionally, the level of coverage and deductible you choose can also impact the cost of your policy. It’s important to understand these factors and how they can affect your insurance premiums.

One factor that can influence the cost of car insurance for your Chevrolet Tahoe is your driving history. Insurance companies typically consider factors such as the number of accidents or traffic violations you have had in the past. If you have a clean driving record with no accidents or tickets, you may be eligible for lower insurance rates.

Another factor that can affect your Chevrolet Tahoe car insurance rates is the location where you live. Insurance companies take into account the crime rate and the likelihood of theft or vandalism in your area. If you live in a high-crime area, you may have higher insurance premiums compared to someone living in a safer neighborhood. See more details on our “Anti Theft System Car Insurance Discount.”

Understanding the Importance of Car Insurance for Your Chevrolet Tahoe

Car insurance is not just a legal requirement in most states but also a crucial financial protection. Accidents can happen at any time, and the costs associated with repairing or replacing a Chevrolet Tahoe can be substantial.

Car insurance provides coverage for repairs, medical expenses, liability claims, and more, ensuring you are financially protected in the event of an accident. Understanding the importance of having adequate car insurance for your Chevrolet Tahoe is essential to avoid unexpected financial burdens. Check out insurance savings in our complete “Car Accidents: What to do in Worst Case Scenarios.”

Additionally, car insurance can also provide coverage for other unforeseen events such as theft, vandalism, or natural disasters. These incidents can cause significant damage to your Chevrolet Tahoe, and without insurance, you may be left with a hefty bill to repair or replace your vehicle. By having comprehensive coverage, you can have peace of mind knowing that you are protected against a wide range of risks.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Options for Your Chevrolet Tahoe

When shopping for car insurance for your Chevrolet Tahoe, it’s essential to compare different options to find the coverage that suits your needs and budget.

Consider factors such as coverage limits, deductibles, and additional features like roadside assistance or rental car reimbursement. Getting quotes from multiple insurance providers allows you to compare rates and coverage details, enabling you to make an informed decision about the best insurance option for your Chevrolet Tahoe.

One important factor to consider when comparing car insurance options for your Chevrolet Tahoe is the reputation and financial stability of the insurance provider. It’s crucial to choose an insurance company that has a strong track record of customer satisfaction and prompt claims processing. Researching customer reviews and ratings can help you gauge the reliability and trustworthiness of different insurance providers.

Additionally, it’s worth exploring any discounts or special offers that insurance companies may have specifically for Chevrolet Tahoe owners. Some insurers offer discounts for safety features such as anti-lock brakes, airbags, and anti-theft devices.

Others may provide loyalty discounts for long-term policyholders or bundle discounts if you have multiple insurance policies with the same company. Taking advantage of these discounts can help you save money on your car insurance premiums.

Tips for Finding Affordable Car Insurance for Your Chevrolet Tahoe

While car insurance for a Chevrolet Tahoe may seem expensive, there are several strategies to find affordable coverage. Maintaining a clean driving record, bundling your car insurance with other policies, shopping around for the best rates, and taking advantage of available discounts are just a few ways to lower your insurance costs. Discover more about offerings in our “Car Driving Safety Guide for Teens and Parents.”

By implementing these tips, you can find affordable car insurance that still provides the necessary coverage for your Chevrolet Tahoe.

Jeff Root Licensed Life Insurance Agent

Another strategy to find affordable car insurance for your Chevrolet Tahoe is to consider increasing your deductible. A higher deductible means you will have to pay more out of pocket in the event of an accident, but it can significantly lower your monthly premium. Before choosing a higher deductible, make sure you have enough savings to cover the increased cost in case of an accident.

Additionally, it is important to review your coverage periodically to ensure you are not paying for unnecessary extras. Evaluate your policy and determine if there are any add-ons or coverage options that you do not need. By removing these extras, you can further reduce your car insurance costs without sacrificing the necessary coverage for your Chevrolet Tahoe.

The Average Cost of Insuring a Chevrolet Tahoe: A Comprehensive Analysis

Examining the average cost of insuring a Chevrolet Tahoe is crucial for potential buyers. It’s essential to understand the industry averages, including the impact of factors such as age, location, driving history, and coverage options.

The average cost of insuring a Chevrolet Tahoe varies considerably based on the insurer and the level of coverage selected. At the lower end, USAA offers the most competitive monthly rates for minimum coverage at $53, making it an attractive option for those seeking affordability without compromising on quality.

Meanwhile, for full coverage, premiums are higher, with USAA still leading in affordability at $153 per month. Other insurers, such as Auto-Owners and Erie, provide mid-range pricing, with monthly rates for full coverage at $172 and $148, respectively. On the higher end, companies like The General charge up to $202 per month for full coverage, reflecting a premium service.

This range shows that while there are affordable options available, the extent of coverage and the specific needs of the Tahoe owner can significantly influence the final insurance costs.

By reviewing a comprehensive analysis of average insurance costs for different models of the Chevrolet Tahoe, buyers can budget and plan accordingly to ensure they can afford the ongoing insurance premiums. Delve into our evaluation of “What is included in comprehensive car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Types of Coverage for Your Chevrolet Tahoe Car Insurance

There are various types of coverage to consider when it comes to insuring your Chevrolet Tahoe. Liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage are some of the options available. Access comprehensive insights into our “What is comprehensive coverage?”

Each type of coverage provides specific benefits, so it’s crucial to understand what they entail and how they can protect you financially. Exploring these different coverage options ensures you make an informed decision about the extent of protection you want for your Chevrolet Tahoe.

How to Save Money on Your Chevrolet Tahoe Car Insurance Premiums

Saving money on your Chevrolet Tahoe car insurance premiums is possible with the right approach. Implementing strategies such as raising your deductible, maintaining a clean driving record, taking advantage of discounts, and choosing an appropriate level of coverage can all contribute to lower insurance costs.

Understanding how to save money on your car insurance premiums without compromising necessary coverage is essential for Chevrolet Tahoe owners. Unlock details in our “Full Coverage Car Insurance: A Complete Guide.”

Common Misconceptions About Insuring a Chevrolet Tahoe Debunked

There are several common misconceptions when it comes to insuring a Chevrolet Tahoe. Some believe that owning a larger vehicle automatically means higher insurance premiums, while others assume that comprehensive coverage is not necessary for a new Tahoe.

Debunking these misconceptions helps car owners make more informed decisions about their insurance needs and avoid potential pitfalls. Discover insights in our “Commonly Misunderstood Insurance Concepts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Consider When Choosing the Right Car Insurance Policy for Your Chevrolet Tahoe

Choosing the right car insurance policy for your Chevrolet Tahoe requires careful consideration of several factors. These include coverage limits, deductibles, add-ons, discounts, and the reputation and financial stability of the insurance company. Learn more in our “Lesser Known Car Insurance Discounts.”

Evaluating these factors and understanding what to consider when selecting the right policy ensures you have the appropriate coverage for your Chevrolet Tahoe and peace of mind on the road.

The Benefits of Comprehensive Coverage for Your Chevrolet Tahoe Car Insurance

Comprehensive coverage for your Chevrolet Tahoe car insurance provides protection against a wide range of risks, including theft, vandalism, natural disasters, and more. See more details on our “Is car theft covered by car insurance?”

Understanding the benefits of comprehensive coverage helps car owners make an informed decision about whether to include this type of coverage in their insurance policy. Taking into account the potential risks and the value of your Chevrolet Tahoe, comprehensive coverage can offer enhanced protection and peace of mind.

Understanding the Deductible and Its Impact on Your Chevrolet Tahoe Car Insurance Rates

The deductible is an important aspect of your Chevrolet Tahoe car insurance policy. Understanding how the deductible works and considering the impact it has on your insurance rates is crucial. Delve into our evaluation of “Do auto and renters insurance claims affect my home insurance rates?”

A higher deductible typically lowers the cost of your premiums but means you’ll have to pay more out of pocket in the event of a claim. Assessing your personal financial situation and risk tolerance is essential when deciding on the deductible for your Chevrolet Tahoe car insurance policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That May Increase or Decrease the Cost of Insuring a Chevrolet Tahoe

Various factors can affect the cost of insuring a Chevrolet Tahoe. For example, having a good credit score, maintaining a clean driving record, and living in an area with low crime rates can potentially lower insurance premiums.

Melanie Musson Published Insurance Expert

On the other hand, factors like a poor credit score, a history of accidents or tickets, or residing in an area prone to natural disasters can increase insurance costs. Recognizing these factors and how they impact your insurance rates allows you to be more prepared when obtaining insurance quotes for your Chevrolet Tahoe. Discover more about offerings in our “Best Car Insurance Discounts for Drivers With No Tickets.”

Tips for Lowering Your Chevrolet Tahoe Car Insurance Rates Without Compromising Coverage

Lowering your Chevrolet Tahoe car insurance rates without compromising coverage can be achieved through various strategies. Some effective tips include taking defensive driving courses, maximizing available discounts, bundling policies, and exploring usage-based insurance programs. Access comprehensive insights into our “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

By implementing these tips, Chevrolet Tahoe owners can save money on insurance while still maintaining adequate coverage for their vehicle.

The Importance of Shopping Around for the Best Car Insurance Rates for Your Chevrolet Tahoe

When it comes to insuring your Chevrolet Tahoe, shopping around for the best car insurance rates is highly recommended. Insurance companies have different rating systems, discounts, and pricing structures, so obtaining quotes from multiple providers allows you to compare and find the most competitive rates.

By investing time and effort into comparing car insurance options, you can potentially save significantly on your Chevrolet Tahoe insurance premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Additional Coverage Options for Enhanced Protection on Your Chevrolet Tahoe

In addition to standard coverage options, such as liability, collision, and comprehensive, there may be additional coverage options that provide enhanced protection for your Chevrolet Tahoe. These can include roadside assistance, rental car reimbursement, and new car replacement coverage. Delve into our evaluation of “Collision Car Insurance: A Complete Guide.”

Exploring these additional coverage options and considering their benefits can help you tailor your insurance policy to suit your specific needs and enhance the protection for your Chevrolet Tahoe.

How to Qualify for Discounts on Your Chevrolet Tahoe Car Insurance Policy

Qualifying for discounts can help lower your Chevrolet Tahoe car insurance premiums. Insurance companies offer discounts for various reasons, such as having a good driving record, bundling policies, installing anti-theft devices, or being a safe driver. Unlock details in our “Best Safe Driver Car Insurance Discounts.”

Understanding how to qualify for these discounts and taking advantage of the available savings opportunities can result in further cost reductions on your Chevrolet Tahoe car insurance policy.

The Impact of Location on the Cost of Insuring a Chevrolet Tahoe

Where you live can have a significant impact on the cost of insuring your Chevrolet Tahoe. Urban areas with higher crime rates and more traffic congestion tend to have higher insurance premiums compared to rural or suburban areas. Discover insights in our “Traffic School Can Lower Your Car Insurance Rates.”

Understanding the impact of location on insurance rates allows you to anticipate and budget for the potential cost differences in different regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes to Avoid When Purchasing Car Insurance for Your Chevrolet Tahoe

When purchasing car insurance for your Chevrolet Tahoe, it’s important to avoid common mistakes that can lead to inadequate coverage or paying more than necessary. Learn more in our “Best Car Insurance Discounts to Ask for.”

Some common mistakes include underinsuring your vehicle, not comparing quotes from multiple providers, neglecting to consider the reputation and customer service of the insurance company, and failing to review and update your policy regularly. Being aware of these mistakes helps you make better choices when buying insurance for your Chevrolet Tahoe.

Expert Advice on Finding the Most Suitable and Cost-Effective Car Insurance for a Chevrolet Tahoe

Seeking expert advice is invaluable when it comes to finding the most suitable and cost-effective car insurance for your Chevrolet Tahoe. Insurance agents and independent experts can provide guidance on coverage options, discounts, and reputable insurance companies to consider. By tapping into their experience and knowledge, Chevrolet Tahoe owners can make informed decisions and secure the best insurance policy for their needs.

With all these insights and information, you are now well-equipped to understand the cost of insuring a Chevrolet Tahoe.

Ty Stewart Licensed Insurance Agent

By considering the various factors that influence insurance rates, exploring different coverage options, and implementing cost-saving strategies, you can find affordable and comprehensive car insurance for your Chevrolet Tahoe. See more details on our “Car and Home Insurance Discounts.”

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of Chevrolet Tahoe car insurance?

The cost of Chevrolet Tahoe car insurance can be influenced by various factors such as the driver’s age, location, driving record, coverage options, deductible amount, and the insurance company’s rates.

For additional details, explore our comprehensive resource titled “Cheapest Car Insurance for 23-Year-Old Drivers.”

Are Chevrolet Tahoe cars expensive to insure?

Insurance rates for Chevrolet Tahoe cars can vary depending on the factors mentioned above. However, due to its size and power, the Chevrolet Tahoe may generally have higher insurance rates compared to smaller vehicles.

Does the Chevrolet Tahoe’s safety features affect insurance rates?

Yes, the safety features of the Chevrolet Tahoe can impact insurance rates. Vehicles equipped with advanced safety features such as anti-lock brakes, airbags, traction control, and electronic stability control may qualify for discounts on insurance premiums.

Can I get discounts on Chevrolet Tahoe car insurance?

Yes, there are several potential discounts available for Chevrolet Tahoe car insurance. These may include discounts for bundling multiple policies, having a good driving record, being a safe driver, or installing anti-theft devices in your vehicle.

What is the average cost of Chevrolet Tahoe car insurance?

The average cost of Chevrolet Tahoe car insurance can vary depending on several factors. It is recommended to obtain personalized quotes from different insurance providers to get an accurate estimate based on your specific circumstances.

To find out more, explore our guide titled “How To Get Free Insurance Quotes Online.”

How can I find affordable Chevrolet Tahoe car insurance?

To find affordable Chevrolet Tahoe car insurance, it is advisable to compare quotes from multiple insurance companies. Additionally, maintaining a clean driving record, opting for higher deductibles, and exploring available discounts can help reduce cost of your insurance.

How can I reduce my Chevy Tahoe insurance cost?

To reduce your Chevy Tahoe insurance cost, consider increasing your deductible, maintaining a clean driving record, and qualifying for discounts such as multi-policy bundling or safe driver programs. Additionally, comparing quotes from various insurers can also lead to lower rates.

Do Tahoes last long?

Chevy Tahoes are recognized for their durability, often surpassing 200,000 miles with appropriate care. According to a study by iseecars.com, these vehicles can potentially last up to 250,000 miles, although such longevity is uncommon.

Is insurance on a V8 more?

Indeed, engine size influences insurance costs as insurers consider specific vehicle characteristics when setting car insurance rates. Typically, vehicles with larger, more powerful engines are costlier to insure monthly because they are linked to quicker and more hazardous driving behaviors.

To learn more, explore our comprehensive resource on “Best Car Insurance by Vehicle.”

Why is full car insurance so expensive?

A full-coverage policy is generally two and a half times more expensive than one offering only minimum liability coverage. This higher cost is due to the inclusion of comprehensive and collision insurance, which covers the expenses to repair or replace your vehicle if it gets damaged.

What makes car insurance full coverage?

What is the cheapest Chevy to insure?

Are newer or older cars cheaper to insure?

Are Chevy cars worth buying?

Do Tahoes use a lot of gas?

Who is known for cheapest car insurance?

Is Allstate or Geico more expensive?

Do Chevy Tahoes hold their value?

Is it cheaper to insure a car or SUV?

Why do people love Chevy Tahoes?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.