Allstate vs. COUNTRY Financial Homeowners Insurance in 2026 (Side-by-Side Comparison)

Allstate and COUNTRY Financial homeowners insurance offer rates of $88 and $123 monthly. This Allstate vs. COUNTRY Financial homeowners insurance review highlights Allstate's water backup and ID theft coverage and COUNTRY Financial's personal injury and high-value items protection coverage.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated August 2025

11,638 reviews

11,638 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 452 reviews

452 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

452 reviews

452 reviewsAllstate vs. COUNTRY Financial homeowners insurance highlights strengths that meet diverse homeowner needs.

Allstate shines with features like identity theft restoration and water backup coverage, providing custom protection for unexpected situations.

Allstate vs. Country Financial Homeowners Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 3.9 | 4.5 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 4.0 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 3.9 |

| Coverage Value | 3.4 | 4.6 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.4 | 4.8 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 3.8 | 4.9 |

| Allstate | Country Financial |

COUNTRY Financial, famous for its approach, offers personal injury insurance and high-value items protection to protect your most valued objects. Both companies provide strong coverage choices, but their uncommon services focus on different priorities.

This article investigates how these providers compare to assist you in finding the best match for your house. Enter your ZIP code to find deals on Allstate vs. COUNTRY Financial home insurance.

- Allstate and COUNTRY Financial differ in coverage and pricing

- Allstate offers ID theft protection and water backup coverage

- COUNTRY Financial provides personal injury and item protection

Comparing Allstate vs. COUNTRY Financial Monthly Rates by Age and Gender

This table shows how age and gender affect the monthly lowest insurance rates for Allstate and COUNTRY Financial homeowners. It brings out differences in premiums among main groups of people, providing important information about cost patterns to potential policyholders.

Allstate vs. Country Financial Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender |  |

|

|---|---|---|

| Age: 16 Female | $120 | $115 |

| Age: 16 Male | $125 | $120 |

| Age: 30 Female | $85 | $80 |

| Age: 30 Male | $90 | $83 |

| Age: 45 Female | $75 | $70 |

| Age: 45 Male | $80 | $73 |

| Age: 60 Female | $70 | $67 |

| Age: 60 Male | $72 | $70 |

For females who are 16 years old, Allstate asks for a $120 payment. COUNTRY Financial gives a lower price of $115. For males of the same age, the charge is around $125 and $120 in that order. Discover how much homeowners insurance costs and find the best rates.

The difference in cost was reduced for older groups. Women aged 45 pay $75 with Allstate and $70 through COUNTRY Financial. When they reach the age of 60, both companies have their lowest prices, where Allstate costs $70 while COUNTRY Financial offers only $67 to women. Generally speaking, rates from COUNTRY Financial are lower than those of others in all groups or categories.

Allstate vs. COUNTRY Financial Home Insurance Monthly Rates by Policy

| Insurance Company | $200k Policy | $300k Policy | $500k Policy |

|---|---|---|---|

| $88 | $116 | $149 | |

| $92 | $168 | $138 | |

| $123 | $172 | $236 |

| $113 | $266 | $231 | |

| $75 | $110 | $160 | |

| $63 | $96 | $142 |

| $43 | $61 | $81 |

| $88 | $108 | $166 | |

| $200 | $268 | $274 | |

| $72 | $106 | $133 |

The above table shows the most minor monthly charges for homeowners insurance policies from top companies, such as Allstate and COUNTRY Financial. It gives an easy comparison that aids homeowners in checking affordability and selecting what suits them best.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insights From COUNTRY Financial vs. Allstate Home Insurance Reviews and Ratings

The table for comparison gives a detailed split of Allstate and COUNTRY Financial’s performance based on customer ratings and assessments from the industry. It emphasizes measures such as satisfaction, grievances, and financial stability, which provide important knowledge to homeowners about the advantages of each provider.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Country Financial

| Agency |  |

|

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 74/100 Good Customer Feedback |

|

| Score: 1.45 Avg. Complaints | Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A+ Superior Financial Strength |

Allstate scores 832/1,000 in J.D. Power ratings, while COUNTRY Financial leads with 849/1,000. Both earn A+ for business practices and financial strength from A.M. Best. Consumer Reports gives them equal scores of 74/100, but COUNTRY Financial edges ahead with fewer complaints (0.58) than Allstate’s 1.45.

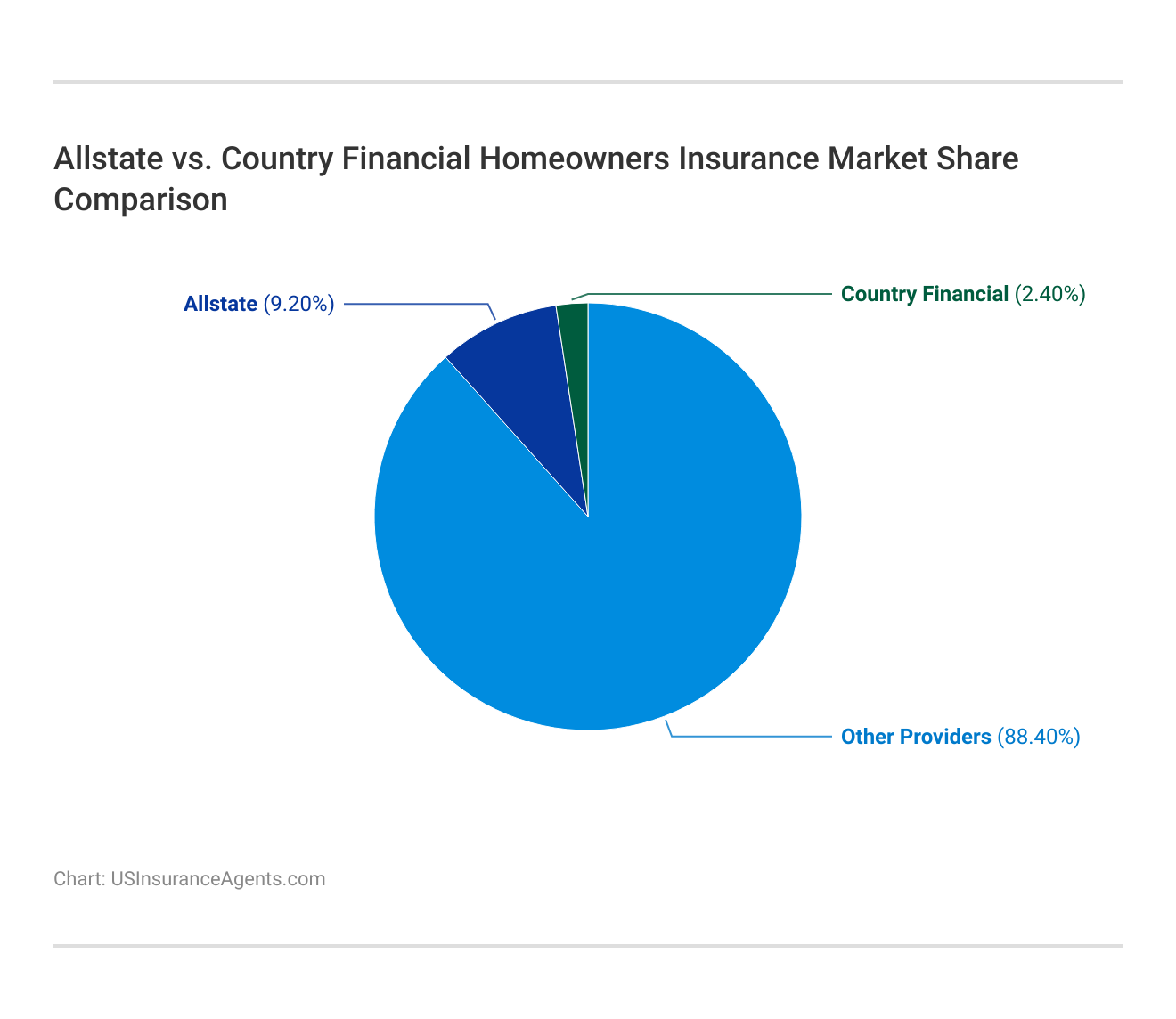

The table shows the percentage of market share that Allstate and COUNTRY Financial hold in the industry of homeowners insurance. It gives a look at how they stand amongst other service providers in this business field.

Comment

byu/Worddroppings from discussion

inplano

A Reddit user switched to Allstate to save money after the American Family raised rates but faced issues with roof damage claims. While auto hail damage was resolved, delays and unresponsive adjusters left their roofs unrepaired for months. Contractors also criticized Allstate’s slow claims process for homeowners.

Coverage Options Offered by Allstate and COUNTRY Financial

When comparing Allstate’s and COUNTRY Financial’s homeowners insurance coverage options, it’s essential to understand what each company offers.

Allstate Homeowners Insurance Coverage

Allstate offers many kinds of coverage options that look after your home and personal belongings. These choices are suited to fulfill different homeowner’s needs, giving full protection against unforeseen happenings.

- Dwelling Coverage: Protects the structure of your home, including walls, roof, and foundation.

- Coverage for Personal Property: It covers damage or loss to things you own, like furniture, electronic items, and appliances.

- Liability Protection: It guards you against legal expenses and costs should someone get hurt on your property.

- More Living Expenses: These include costs such as staying and eating if your house cannot be lived in because of a covered event.

- Water Backup Coverage: It protects against damage caused when drains or sump pumps are backed up.

Allstate offers a variety of coverage options. This lets homeowners trust that their property and assets are safeguarded from unexpected events.

COUNTRY Financial Homeowners Insurance Coverage

COUNTRY Financial gives complete homeowners insurance options to guard your house and belongings. Their policies are centered on providing flexible and personalized defense for accommodating the different needs of homeowners.

- Dwelling Protection: It safeguards the structure of your house, such as walls, roof, and foundation, from specific risks.

- Covering of Personal Property: It safeguards furniture, electronics, and garments from getting spoiled or lost.

- Liability Insurance: It gives you financial safeguarding if you are found culpable for harm or property damage to other people.

- Coverage for Loss of Use: Includes extra living costs, such as temporary accommodation, if your house cannot be lived in.

- Scheduled Personal Property Coverage: Provides a safety net for expensive things such as jewelry, artworks, or collectors’ items.

With the diverse coverage options of COUNTRY Financial, homeowners have the possibility to tailor their policies to protect their property and personal possessions. This gives them confidence in difficult moments that might happen unexpectedly.

Discover more by reading our guide: What a Typical Homeowner Insurance Policy Covers

Exploring Savings: Allstate vs. COUNTRY Financial Homeowners Insurance

This table demonstrates how homeowners can save money by comparing the discounts given by Allstate and COUNTRY Financial. It highlights particular chances to lower premiums by combining policies or keeping a record without claims. Learn how to get free insurance quotes online quickly and easily.

Allstate vs. COUNTRY Financial Homeowners Insurance by Savings Potential

| Discount Name |  |

|

|---|---|---|

| Bundling | 25% | 20% |

| Claims-Free | 20% | 10% |

| Bundle (with Auto) | 15% | 15% |

| New Home | 10% | 15% |

| Renovation | 10% | 10% |

| Protective Devices | 10% | 10% |

| Loyalty | 10% | 5% |

| Early Signing | 5% | 5% |

| Gated Community | 5% | 5% |

| Automatic Payment | 5% | 5% |

Allstate is ahead in giving package discounts, offering savings of up to 25% compared with the 20% of COUNTRY Financial. Homeowners without claims can save 20% if they choose Allstate, but only half this amount or 10% if they go for COUNTRY Financial.

Both providers offer the same main discounts, such as for auto bundling and renovation, at a rate of 15% and 10%, respectively. For new home discounts, COUNTRY Financial slightly goes ahead by giving 15% in comparison to Allstate’s offering of 10%. This becomes appealing specifically for those buying homes for the first time.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Service and Claims Process of Allstate and COUNTRY Financial

When it comes to homeowners insurance, excellent customer service and a seamless claims process are essential. Let’s evaluate the customer service experience with Allstate and COUNTRY Financial.

Allstate is known for its outstanding customer service, providing policyholders with access to knowledgeable representatives who can assist with policy inquiries, claims, and any other concerns. They also offer a user-friendly website and mobile app, making it easy to manage your policy and file claims online.

COUNTRY Financial also prides itself on its excellent customer service. Their representatives are readily available to address policyholder questions and provide guidance throughout the claims process. COUNTRY Financial’s website and mobile app are designed to simplify policy management and claims filing, ensuring a hassle-free experience for their customers.

Introduction to Allstate and COUNTRY Financial

Allstate and COUNTRY Financial are well-respected insurance companies with over 90 years of experience. They provide homeowners insurance to safeguard your house.

Laura Walker Former Licensed Agent

The slogan of Allstate is “You’re in Good Hands,” a phrase that many people know because the company offers dependable coverage and excellent service. Although COUNTRY Financial may not be as popular, it still gains people’s trust by providing customized solutions.

Overview of Allstate Homeowners Insurance

Homeowners insurance from Allstate gives you flexible protection for your houses, personal belongings, and responsibilities. There are also extra options like helping restore identity theft and water backup. Insurance policies are suitable for single-family homes, condos, or rentals. Allstate is known to manage claims well, and it ensures fast recovery from any losses that have effective coverage.

Overview of COUNTRY Financial Homeowners Insurance

COUNTRY Financial homeowners insurance gives you the chance to customize your coverage. This includes protection for your home, personal belongings, responsibility, and loss of use protection.

Known for its personalized service, it gives advice based on an individual’s needs with optional improvements such as injury coverages and high-value items protection. Many positive reviews mention their agents’ deep knowledge and dedication to safeguarding homeowner’s investments.

Read more: Tips for How to Get Cheap Home Insurance

Allstate Homeowners Insurance Pros and Cons

Pros:

- Customizable Plans: Adjusted to different property needs and coverage requirements.

- Financial Strength With A+: Guarantees continued reliability and safety.

- Large Discounts: By bundling together or not having claims lowers the costs a lot.

Cons:

- Costs Could be Higher: Prices might surpass usual levels for certain customer types.

- Customization Shortfall: The service may not feel as personal when compared to local rivals.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

COUNTRY Financial Homeowners Insurance Pros and Cons

Pros:

- Support Personally: Agents concentrate on modifying coverage based on the homeowner’s needs.

- Cost Reasonably: Charge attracts particular demographics and profiles.

- Audience Contentment: Feedback emphasizes agents who are reactive and well-informed.

Cons:

- Regional Limits: There may be less accessibility because of the smaller national presence.

- Lesser Discounts: The discounts are not as wide-ranging in comparison to bigger insurance companies.

Learn more by checking out our guide: Home Features That Can Make Homeowners Insurance More Expensive

Evaluating Homeowners Insurance for Better Protection

The homeowner’s insurance from Allstate and COUNTRY Financial meets the different needs of homeowners. Allstate offers specific coverages such as identity theft restoration and water backup protection, while COUNTRY Financial gives you lower monthly costs with more personalized service.

People who own houses and want a wider range of protection could be more attracted to Allstate’s offerings, whereas those who prioritize affordability may prefer Country Financial’s services. Learn about rates in our Allstate insurance review & ratings.

Explore cheap rates from COUNTRY Financial vs. Allstate by entering your ZIP code.

Frequently Asked Questions

Which is better for homeowners insurance, Allstate vs. 21st Century?

Allstate offers customizable policies with features like ID theft restoration, while 21st Century focuses on affordability but with limited coverage options. Compare both to determine which suits your needs. See how it compares in our 21st Century insurance review.

What do COUNTRY Financial home insurance reviews highlight?

COUNTRY Financial insurance reviews praise its personalized service and competitive rates but sometimes note slower claims processing. It’s well-suited for homeowners seeking tailored coverage. See how Allstate vs. COUNTRY Financial homeowners insurance compares by entering your ZIP code into our free quote tool today.

What do reviews of Allstate homeowners insurance reveal?

Most Allstate homeowners insurance reviews commend it for its flexible coverage options and responsive claims service but mention higher premiums compared to some competitors. Discounts can help lower costs.

How does Allstate vs. Safeco compare for homeowners insurance?

Allstate provides broad coverage options, such as water backup and ID theft, while Safeco offers savings through bundling and unique add-ons, like equipment breakdown coverage. Find key ratings in our Safeco insurance review.

What’s the difference between COUNTRY Financial vs. State Farm for homeowners insurance?

COUNTRY Financial emphasizes personalized service and discounts for safety upgrades. At the same time, State Farm offers broader nationwide coverage and a user-friendly claims process. Monthly rates typically start at $42 for COUNTRY Financial and $40 for State Farm.

Is COUNTRY Financial a good insurance company for homeowners?

COUNTRY Financial is a good insurance company. It is known for personalized service, competitive rates starting at $42 monthly, and tailored coverage options.

What do COUNTRY Financial auto insurance reviews highlight?

COUNTRY Financial car insurance reviews praise its affordable rates and discounts for safety features but note occasional claims processing delays. It’s well-suited for budget-conscious drivers.

How does Allstate vs. Nationwide compare for homeowners insurance?

Allstate offers features like water backup and ID theft restoration, while Nationwide stands out for its free annual policy review and better bundling discounts. Explore policy details in our Nationwide insurance review.

What do COUNTRY Financial’s life insurance reviews say?

COUNTRY Financial life insurance reviews highlight strong customer service, customizable policy options, and competitive monthly rates, though some mention limited online tools compared to larger providers.

What are the common complaints in COUNTRY Financial reviews?

Some reviews mention slower claims processing and limited online tools, but most highlight strong customer service and competitive pricing.

Why is COUNTRY Financial insurance considered expensive?

How does COUNTRY Financial vs. State Farm compare for homeowners insurance?

Who are the best and worst homeowners insurance companies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.