Cheap Toyota Echo Car Insurance in 2026 (Save Big With These 10 Companies!)

American Family, USAA, and Progressive offer the best rates for cheap Toyota Echo car insurance, starting at just $44 monthly. Each company provides unique benefits tailored to different driver needs, ensuring they stand out as top picks for Toyota Echo owners seeking quality and affordability.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated September 2024

Company Facts

Min. Coverage for Toyota Echo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Echo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Echo

A.M. Best Rating

Complaint Level

Pros & Cons

The top providers for cheap Toyota Echo car insurance are American Family, USAA, and Progressive, known for their competitive coverage options and customer satisfaction.

These companies excel in affordability and offer a range of benefits tailored to the specific needs of Toyota Echo owners. By comparing their quotes, you can ensure you’re getting the most cost-effective policy for your vehicle.

Our Top 10 Company Picks: Cheap Toyota Echo Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $44 A++ Affordable Rates American Family

#2 $47 A++ Military Families USAA

#3 $49 A++ Flexible Plans Progressive

#4 $52 A Bundle Savings Liberty Mutual

#5 $54 A Comprehensive Coverage Travelers

#6 $57 A+ Multi-Policy Discounts Nationwide

#7 $59 A++ Customizable Coverage Farmers

#8 $62 A Roadside Assistance AAA

#9 $65 A+ Customer Service Erie

#10 $68 B Reliable Service State Farm

Each insurer also provides unique discounts and coverage enhancements that can significantly reduce the overall cost of insuring your Toyota Echo. Explore insights in our article titled “Toyota Car Insurance Discount.”

Use our free quote comparison tool above to find the cheapest coverage in your area.

#1 – American Family: Top Overall Pick

Pros

- Competitive Pricing: American Family offers the lowest rate for Toyota Echo car insurance at $44 monthly, making it highly affordable.

- Superior Financial Rating: With an A++ from A.M. Best, American Family is a reliable choice for Toyota Echo owners.

- Customized Discounts: Toyota Echo drivers can benefit from multiple discount options tailored to their specific needs. Check out insurance savings in our complete article titled “American Family Insurance Review & Ratings.”

Cons

- Geographical Limitations: American Family may not offer Toyota Echo insurance in all states, limiting accessibility.

- Coverage Restrictions: Some Toyota Echo drivers might find the coverage options more limited compared to competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Tailored to Military: USAA provides specialized car insurance for Toyota Echo owners who are military personnel or their families.

- High A.M. Best Rating: USAA’s A++ rating assures Toyota Echo owners of excellent financial stability. Unlock details in our article titled “USAA Insurance Review & Ratings.”

- Competitive Rates: At $47 monthly, USAA offers Toyota Echo insurance at one of the lowest rates available for military families.

Cons

- Limited Eligibility: USAA’s services, including Toyota Echo insurance, are only available to the military community.

- Fewer Physical Locations: Toyota Echo owners might find in-person support limited as USAA primarily operates online.

#3 – Progressive: Best for Flexible Plans

Pros

- Variety of Plans: Progressive offers a range of plans, allowing Toyota Echo owners to find coverage that best fits their budget and needs.

- Loyalty Rewards: Progressive rewards Toyota Echo owners with discounts for long-term loyalty and safe driving.

- Low Rate: Competitive monthly rate of $49 for Toyota Echo insurance. Read up on the “Progressive Insurance Review & Ratings” for more information.

Cons

- Variable Customer Service: Some Toyota Echo owners might experience inconsistency in customer service quality.

- Rate Fluctuations: Progressive may adjust rates more frequently, affecting Toyota Echo owners budgeting for consistent costs.

#4 – Liberty Mutual: Best for Bundle Savings

Pros

- Bundling Advantages: Toyota Echo owners can enjoy significant savings by bundling their car insurance with other policies from Liberty Mutual.

- Diverse Discount Opportunities: Access to a variety of discounts specifically applicable to Toyota Echo insurance needs.

- Robust Coverage Options: Extensive coverage choices for Toyota Echo, backed by an A rating from A.M. Best. If you want to learn more about the company, head to our article titled “Liberty Mutual Review & Ratings.”

Cons

- Higher Base Rates: Despite bundle savings, the base rate for Toyota Echo insurance starts at $52, which is higher than some competitors.

- Coverage Cost Variability: The cost of comprehensive coverage for Toyota Echo can vary significantly based on location and other factors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Extensive Protection: Travelers offers comprehensive coverage options that are ideal for Toyota Echo owners looking for thorough protection.

- Discounts for Multiple Policies: Toyota Echo owners benefit from discounts when they combine multiple policies with Travelers.

- Hybrid/Electric Vehicle Discount: Provides additional discounts for Toyota Echo owners using eco-friendly versions. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

Cons

- Premium Pricing: At $54 monthly, Travelers’ rates for Toyota Echo insurance are higher compared to other top picks.

- Complex Policy Management: Some Toyota Echo owners may find the policy features and management tools less user-friendly.

#6 – Nationwide: Best for Multi-Policy Discounts

Pros

- Generous Multi-Policy Discounts: Offers substantial discounts when Toyota Echo insurance is bundled with other policies.

- Accident Forgiveness: Includes accident forgiveness programs specifically for Toyota Echo insurance. More information is available about this provider in our article titled “Nationwide Insurance Review & Ratings.”

- SmartRide Program: Provides discounts for Toyota Echo drivers who opt into the usage-based SmartRide program.

Cons

- Above Average Rates: Nationwide’s rates for Toyota Echo start at $57, which can be higher than some competitors.

- Policy Variability: Coverage features and discounts for Toyota Echo can vary significantly by state.

#7 – Farmers: Best for Customizable Coverage

Pros

- Highly Customizable Policies: Allows Toyota Echo owners to tailor their coverage extensively to meet specific needs.

- New Car Pledge: Offers replacement cost for new Toyota Echos in the event of total loss within the first few model years.

- Potential Discounts: Provides various discounts for Toyota Echo based on safety features and driver behavior. Discover insights in our article titled “Farmers Insurance Review & Ratings.”

Cons

- Higher Cost: Monthly premiums for Toyota Echo start at $59, making it more expensive than some other options.

- Complexity in Plans: The vast array of options could overwhelm Toyota Echo owners new to insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA is renowned for its comprehensive roadside assistance for Toyota Echo owners.

- Member Benefits: Offers a range of additional member benefits and discounts for Toyota Echo insurance. Access comprehensive insights into our article titled “AAA Insurance Review & Ratings.”

- Full Coverage Options: Provides full coverage options including collision and comprehensive for Toyota Echo.

Cons

- Membership Requirement: Requires a membership fee, adding to the cost for Toyota Echo insurance.

- Variable Service Quality: Service levels for Toyota Echo insurance can vary widely depending on the regional AAA club.

#9 – Erie: Best for Customer Service

Pros

- Exceptional Customer Service: Erie is known for outstanding customer service for Toyota Echo insurance.

- Rate Lock Guarantee: Offers a rate lock feature, ensuring stable premiums for Toyota Echo owners. See more details on our article titled “Erie Insurance Review & Ratings.”

- Annual Policies: Unique annual policy terms provide more stability and less frequent renewals for Toyota Echo owners.

Cons

- Limited Availability: Erie’s coverage for Toyota Echo is not available in all states.

- Higher Starting Rates: Starts at $65 monthly, which is higher than many other providers for Toyota Echo insurance.

#10 – State Farm: Best for Reliable Service

Pros

- Diverse Coverage: Offers a range of coverage options tailored to different needs of Toyota Echo owners. Discover more about offerings in our article titled “State Farm Insurance Review & Ratings.”

- Extensive Network: Benefits from a vast agent network providing personalized service for Toyota Echo insurance.

- Good Driver Discounts: Rewards Toyota Echo owners with discounts for maintaining a clean driving record.

Cons

- Higher Rates: State Farm’s premiums might still be relatively higher for certain coverage levels for Toyota Echo.

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is lower compared to some competitors for Toyota Echo insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for Toyota Echo Insurance: Minimum vs. Full Coverage

When considering insurance for a Toyota Echo, the monthly rates can vary significantly depending on whether you opt for minimum or full coverage. This distinction is crucial as it influences both the cost and the extent of protection provided. Read up on the “Best Car Insurance Discounts to Ask for” for more information.

Toyota Echo Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $62 $120

American Family $44 $105

Erie $65 $125

Farmers $59 $115

Liberty Mutual $52 $110

Nationwide $57 $112

Progressive $49 $108

State Farm $68 $130

Travelers $54 $115

USAA $47 $110

The following table summarizes the monthly rates offered by various insurance providers for both minimum and full coverage for a Toyota Echo. AAA offers minimum coverage at $62 and full coverage at $120, making it one of the higher options available. American Family provides more economical rates with minimum coverage at $44 and full coverage at $105.

State Farm charges the highest rates at $68 for minimum and $130 for full coverage. Erie’s rates are also high at $65 for minimum and $125 for full coverage. Progressive and USAA offer more moderate rates at $49 and $108, and $47 and $110, respectively, balancing affordability with comprehensive protection.

Understanding the Factors That Influence Toyota Echo Car Insurance Rates

When it comes to determining the cost of Toyota Echo car insurance, there are several factors that come into play. Insurance providers consider the make and model of your car, as well as its age, engine size, and value. Additionally, your personal driving history, including any previous accidents, tickets, or claims, will also be taken into account.

Insurance companies also examine statistical data to assess the likelihood of accidents, theft, and vandalism for specific car models. All of these factors, along with your location and the level of coverage you choose, contribute to the final cost of your Toyota Echo car insurance. Explore insurance savings in our comprehensive guide titled “Is car theft covered by car insurance?”

The Importance of Car Insurance for Your Toyota Echo

Car insurance is not only a legal requirement in most states but also provides financial protection in case of accidents or unforeseen events. Having car insurance for your Toyota Echo can help cover the cost of repairs or replacements in case of damage, medical expenses for injuries sustained in accidents, and even legal expenses if you are involved in a lawsuit.

Without car insurance, you may be personally liable for the costs associated with any accidents or damages involving your Toyota Echo. Therefore, it is crucial to have the right car insurance coverage to protect yourself, your passengers, and your investment. Discover more about offerings in our guide titled “How does American Family Insurance handle claims involving hit-and-run accidents?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Types of Car Insurance Coverage for Your Toyota Echo

When it comes to choosing car insurance coverage for your Toyota Echo, there are multiple options available. The most basic type of coverage is liability insurance, which covers damages and injuries you may cause to others in an accident. This is typically the minimum requirement by law.

However, it is advisable to consider additional coverage options such as collision coverage, which protects your vehicle in case of an accident, and comprehensive coverage, which covers damages from non-accident-related incidents such as theft, fire, or natural disasters.

Additionally, uninsured or underinsured motorist coverage can protect you in case the other party involved in an accident does not have sufficient insurance. Understanding the different types of coverage and selecting the ones that best suit your needs is an essential part of securing the right car insurance for your Toyota Echo.

Comparing Car Insurance Quotes for Toyota Echo: How to Find the Best Deal

When it comes to finding the best car insurance deal for your Toyota Echo, it is important to compare quotes from multiple insurance providers. Each company may have different criteria and pricing structures, so it is essential to obtain several quotes to ensure you are getting the most competitive rate. You can request quotes online or contact insurance agents directly.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Keep in mind that the cheapest option may not always provide the best coverage, so consider the overall value and reputation of the insurance provider as well. Taking the time to compare quotes can help you find the best deal for your Toyota Echo car insurance.

Tips for Lowering Your Toyota Echo Car Insurance Premiums

There are several strategies you can employ to lower your Toyota Echo car insurance premiums. One effective way is to maintain a clean driving record. Avoiding accidents, traffic violations, and claims can demonstrate to insurance providers that you are a responsible driver, which can translate into lower premiums.

Additionally, opting for a higher deductible can also result in lower insurance costs. However, it is important to ensure you can afford the deductible amount in case you need to file a claim. Another way to save on insurance is to take advantage of available discounts.

Kristine Lee Licensed Insurance Agent

Many insurance companies offer discounts for safe driving, bundling multiple policies, installing anti-theft devices, or completing defensive driving courses. Research and inquire about available discounts to potentially lower your Toyota Echo car insurance premiums. Access comprehensive insights into our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Does the Age and Condition of Your Toyota Echo Affect Your Insurance Rates

The age and condition of your Toyota Echo affect your insurance rates. Providers consider mileage, maintenance history, and overall vehicle condition. Older cars may be more susceptible to mechanical issues or have a higher risk of breaking down, which can affect insurance rates. Explore our assessment of the guide titled “Does my car insurance cover damage caused by an overheated engine?”

Additionally, the value of the car also plays a role. Generally, as a car ages, its value decreases, which can result in lower insurance premiums. However, if your Toyota Echo is a collectible or has unique modifications, it may be considered a higher risk and lead to higher insurance costs. Accurately report your Toyota Echo’s age and condition when getting car insurance quotes to ensure precise premium estimates.

The Impact of Your Driving Record on Toyota Echo Car Insurance Costs

Your driving record has a significant impact on your Toyota Echo car insurance costs. Insurance providers consider factors such as the number of accidents, tickets, and claims you have had in the past. If you have a history of accidents or traffic violations, insurance companies may consider you a higher risk and charge higher premiums.

On the other hand, a clean driving record with no accidents or violations can result in lower insurance costs. It is crucial to prioritize safe driving habits to maintain a clean driving record, not only for your own safety but also to potentially save money on your Toyota Echo car insurance. Unlock details in our guide titled “Car Driving Safety Guide for Teens and Parents.”

Why Location Matters: How Geography Affects Toyota Echo Car Insurance Rates

Your location can significantly impact your Toyota Echo car insurance rates. Insurance providers analyze statistical data regarding accidents, thefts, and other risks in different areas to determine insurance rates. If you live in a densely populated urban area with a higher risk of accidents or thefts, your insurance premiums may be higher compared to someone living in a rural area with fewer risks.

Additionally, the frequency and severity of natural disasters, such as hurricanes or earthquakes, in your area can also affect your insurance rates. When obtaining Toyota Echo car insurance quotes, ensure you provide your exact location for an accurate premium estimate reflecting local risk factors. Discover insights in our guide titled “Does USAA car insurance cover damage caused by a natural disaster if I only have liability coverage?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Determining the Right Level of Coverage for Your Toyota Echo

When it comes to determining the right level of coverage for your Toyota Echo, it is important to consider your individual needs and budget. While liability insurance is typically the minimum requirement by law, it may not provide sufficient protection if you are involved in a major accident. Learn more in our article titled “Best Car Insurance for Liability Insurance.”

Assess your risk tolerance, the value of your car, and your financial situation to determine if additional coverage options, such as collision and comprehensive coverage, are necessary. It is also important to factor in any loan or lease requirements if you do not fully own your Toyota Echo. Consulting with an insurance professional can help you make an informed decision and ensure you have the right level of coverage for your Toyota Echo.

Understanding Deductibles: How They Can Affect Your Toyota Echo Car Insurance Premiums

Deductibles play a significant role in determining your Toyota Echo car insurance premiums. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Typically, insurance policies offer a range of deductible options. Choosing a higher deductible can result in lower insurance premiums, as you are taking on more of the financial risk in case of an accident or claim.

However, it is essential to ensure you can afford the deductible amount if you need to file a claim. Consider your budget and weigh the potential savings in premiums against the financial burden of a higher deductible to determine the most suitable option for your Toyota Echo car insurance. See more details on our guide titled “How to Document Damage for Car Insurance Claims.”

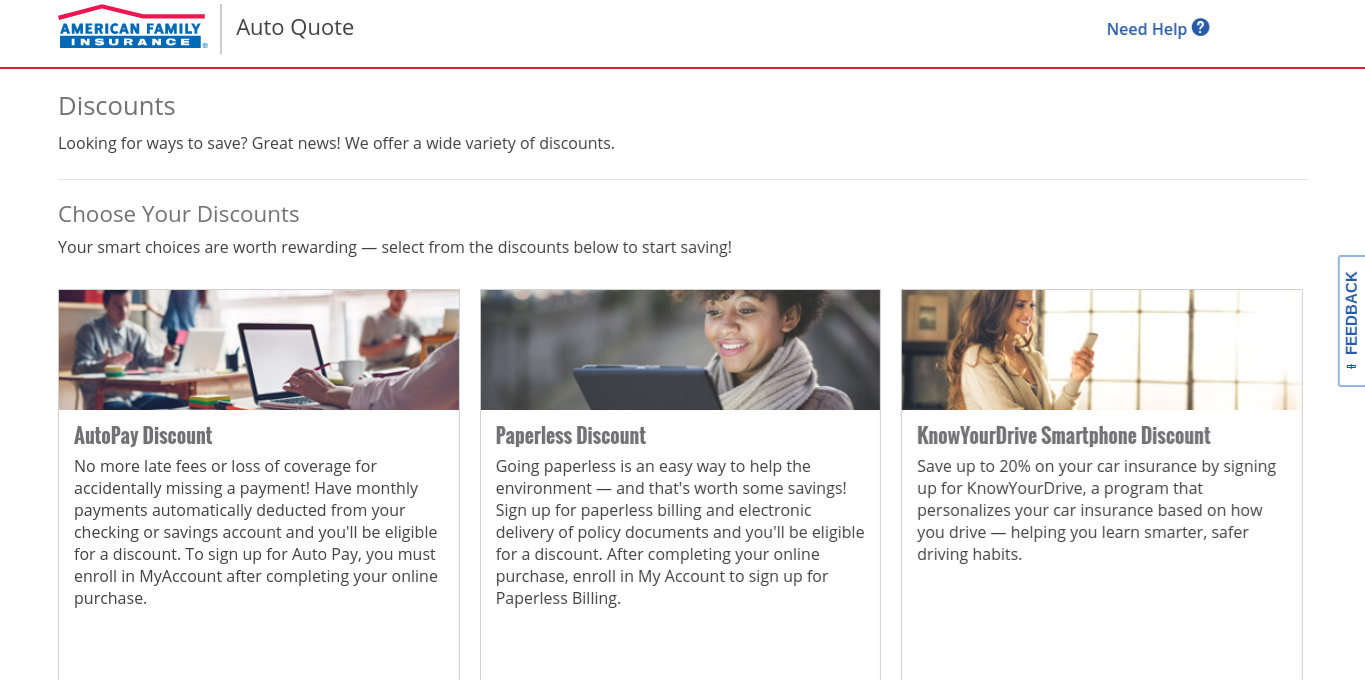

Exploring Discounts and Savings Opportunities for Toyota Echo Car Insurance

Many insurers provide discounts on Toyota Echo car insurance for safe drivers with a clean record and no claims. Bundling your car insurance with other policies, such as homeowner’s or renter’s insurance, can often result in discounted rates. Installing safety features, such as anti-theft devices or safety belts, may also lead to lower premiums. Check out insurance savings in our complete article titled “What is Payment bundling?”

Ty Stewart Licensed Insurance Agent

Additionally, completing defensive driving courses or being a member of certain organizations can make you eligible for discounted rates. Research and inquire about available discounts and savings opportunities to potentially reduce the cost of your Toyota Echo car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Policies: Insuring Your Home and Toyota Echo Together

Insuring your home and Toyota Echo together can have several benefits. Many insurance companies offer multi-policy discounts, which means you can receive a discount on both your homeowner’s insurance and car insurance premiums when you bundle them together. Bundling policies not only leads to potential cost savings but also simplifies the insurance process.

Having both policies with the same insurer allows for easier communication, streamlined claims processes, and a single point of contact for any inquiries or concerns. Consider bundling your home and Toyota Echo insurance policies to potentially save money and enjoy the convenience of dealing with a single insurance provider. Discover more about offerings in our guide titled “Can I bundle my car insurance with other policies?”

Explaining Comprehensive and Collision Coverage Options for Your Toyota Echo

Comprehensive and collision coverage are additional options when it comes to insuring your Toyota Echo. Collision coverage protects your vehicle in case of an accident, regardless of who is at fault. If your Toyota Echo is damaged or totaled in a collision, this coverage can help cover the cost of repairs or replacement.

Comprehensive coverage, on the other hand, covers damages to your vehicle that are not related to accidents, such as theft, vandalism, or damage from natural disasters. Both comprehensive and collision coverage typically require a deductible, which is the amount you are responsible for paying before the insurance coverage kicks in.

When considering comprehensive and collision coverage for your Toyota Echo, be sure to weigh the potential benefits against the additional cost to determine if these options are necessary for your specific situation. To learn more, check out our guide titled “Collision vs. Comprehensive Car Insurance.”

Tips for Filing a Claim and Navigating the Claims Process With Your Toyota Echo Insurer

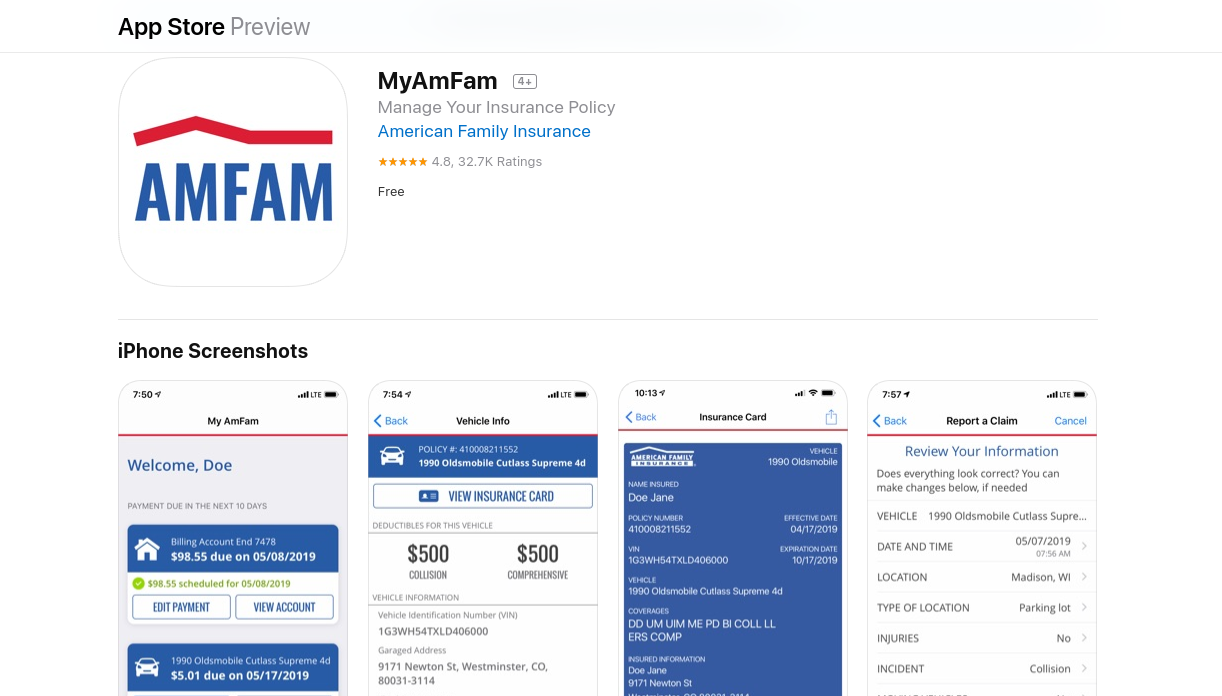

To file a claim for your Toyota Echo, collect key documents such as police reports, damage photos, and witness details. Quickly report the claim to your insurer, provide thorough information, and respond to their inquiries. Since the claims process varies by insurer, learn about their specific procedures and timelines. If issues arise, consult an insurance professional or legal advisor to help navigate the process and safeguard your interests.

In conclusion, the cost of Toyota Echo car insurance depends on factors like the car’s make and model, your driving history, the Toyota Echo’s age and condition, your location, and your chosen coverage level. It is essential to understand the different types of car insurance coverage available, compare quotes from multiple providers to find the best deal, and explore opportunities for discounts and savings.

Additionally, knowing how deductibles, bundling policies, and the claims process can affect your insurance rates and experience is crucial. By considering all these factors and making informed decisions, you can secure the right car insurance coverage for your Toyota Echo while ensuring financial protection and peace of mind.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of Toyota Echo car insurance?

The cost of Toyota Echo car insurance can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductibles, and the insurance company’s pricing structure.

Are Toyota Echo cars generally expensive to insure?

The insurance cost for Toyota Echo cars is typically affordable compared to other vehicles. However, the actual insurance premiums can vary depending on individual circumstances and factors mentioned earlier.

Do Toyota Echo cars have any safety features that can help lower insurance costs?

Toyota Echo cars are equipped with certain safety features that may help reduce insurance costs. These features can include anti-lock brakes, airbags, seat belts, and anti-theft systems. Insurance companies often offer discounts for vehicles with such safety features.

To enhance your understanding, explore our comprehensive resource on insurance titled “Best Safety Features Car Insurance Discounts.”

Are there any specific insurance discounts available for Toyota Echo car owners?

Insurance companies may provide various discounts for Toyota Echo car owners. These can include multi-policy discounts (if you have multiple insurance policies with the same company), safe driver discounts, good student discounts (for students with good grades), and discounts for completing defensive driving courses.

How can I find the best insurance rates for a Toyota Echo car?

To find the best insurance rates for a Toyota Echo car, it is recommended to shop around and compare quotes from multiple insurance companies. You can utilize online insurance comparison tools or contact insurance agents to gather quotes and determine the most suitable coverage options at competitive prices.

Enter your ZIP code below to compare rates from the top providers near you.

Can I lower my Toyota Echo car insurance costs by increasing my deductibles?

Increasing the deductibles on your Toyota Echo car insurance can lower your premiums. By choosing a higher deductible, you reduce the insurer’s risk, resulting in lower costs for you. Ensure the deductible is affordable for you, as it is paid out of pocket before insurance covers any claims.

Who typically has the cheapest insurance?

American Family typically offers the cheapest rates for Toyota Echo car insurance.

For detailed information, refer to our comprehensive report titled “American Family Car Insurance Discounts.”

What is the cheapest level of car insurance?

The cheapest level of car insurance is minimum liability coverage.

Which category is cheapest to insure for Toyota Echo?

The cheapest category to insure for a Toyota Echo is the minimum coverage level.

What is the cheapest full coverage Toyota Echo car insurance?

American Family provides the cheapest full coverage for Toyota Echo car insurance.

To expand your knowledge, refer to our comprehensive handbook titled “Full Coverage Car Insurance: A Complete Guide.”

Is Geico cheaper than Progressive for Toyota Echo car insurance?

What is the best Toyota Echo car insurance for bad credit?

Why is it cheaper to insure a newer Toyota Echo car?

What color car is the most expensive to insure for Toyota Echo?

What is the lowest form of Toyota Echo car insurance?

How to lower Toyota Echo car insurance rates?

At what age is Toyota Echo car insurance cheapest?

What is the cheapest form of car insurance for Toyota Echo?

How much is insurance for a Toyota Echo in 2024?

Why is it cheaper to insure a newer Toyota Echo car?

Is it cheaper to insure a Toyota Corolla or Toyota Echo?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.